what is suta tax rate

The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee. What is SUTA.

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Texas law sets an employers tax rate at their NAICS industry average or 27 percent whichever.

. The contribution rate is determined by the employers experience rating. The revenue raised is used to fund unemployment benefits. What is Hawaii unemployment tax rate.

California has four state payroll taxes. There is no taxable wage limit. 0010 10 or 700 per employee.

An employers SUTA rate is often referred to as a contribution rate. Employer UI tax rate notices are available online for the following rate years. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays.

The withholding rate is based on the employees Form W-4 or DE 4. Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825. Louisiana Unemployment Insurance Tax Rates.

9000 taxable wage base x 27 tax rate x number of employees Texas SUTA cost for the year. If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the construction industry in which case the the 2019 rate is 59 the 2020 rate. As of 2021 the FUTA tax rate is 6 of the first.

In order to pay your SUTA tax youll first need to create an account with. Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage base. As of 2021 the FUTA tax rate is 6 of the first 7000 paid to each employee annually.

This percentage is applied to taxable wages paid to determine the amount of employer contributions due. Businesses usually file these taxes through their state anytime between October and December. 2022 PDF 2021 PDF 2020 PDF.

The tax does not apply to earnings over 7000. States that raised unemployment tax rates for 2022 and their new ranges include. New businesses in Texas start with a SUTA tax rate of 27.

Tax Rate for New Employers. Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. The FUTA tax rate is 6 on the first 7000 of an employees earnings.

Employees are exempt from FUTA so they do not pay this tax. You can view your tax rate by logging in to the Departments Reemployment Tax file and pay website. The Federal Unemployment Tax Act FUTA is legislation that imposes a payroll tax on any business with employees.

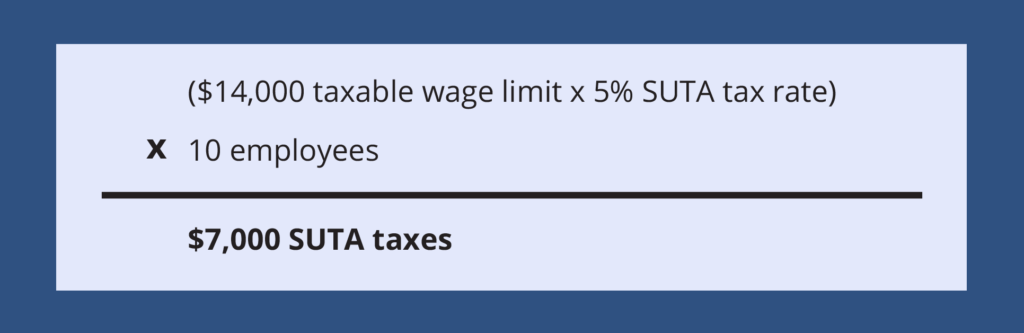

The federal government applies a standard 6. To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees. A typical SUTA rate ranges from 2-4.

The FUTA and SUTA taxes are filed on Form 940 each year. The Federal Unemployment Tax Act FUTA is a federal payroll tax that employers pay on employee wages. A Contribution Rate Notice Form UC-657 is mailed to employers at the end of each calendar year and shows the contribution rate effective for the coming calendar year.

Form W-4 or DE 4 on file with their employer. There is no maximum tax. When the United States Department of Labor certifies that the states unemployment compensation program meets federal requirements employers that pay their state unemployment tax on time and in full receive a 54 percent credit to be applied against their FUTA tax rate.

Heres how an employer in Texas would calculate SUTA. 0540 54 or 378 per employee. For experience-rated employers those with three or more years of experience the contribution rate is based on a ratio called the benefit ratio which is determined in such a way that the greater the unemployment caused by the employer the higher the rate.

4 rows FUTA is federally managed and states regulate SUTA. What is the FUTA rate for 2021. This means the effective federal tax rate is 06 percent.

Review the PIT. How do I pay state unemployment tax. Once you know your assigned tax rate youll be able to calculate the amount of SUTA tax youll need to pay for each employee.

Tax Rate Schedule and Weekly Benefit Amount. This contribution rate notice serves to notify employers of their. The 2022 wage base is 7700.

Fortunately most employers pay little SUTA tax if they havent had employees file unemployment claims. 52 rows The tax rates are updated periodically and might increase for. Click here for an historical rate chart.

The maximum FUTA tax an employer is required to pay is 420. Each state agency will send your company a SUTA rate notice providing a breakdown of how rates are determined. SUTA isnt as cut and dry as the FUTA as it varies by state.

For pre-existing businesses the states determine what your tax rate will be within the minmax range each year. To see the tax rate schedule ratio rate table and the FUTA creditable factors for ratio-rated employers select the year. The yearly cost is divided by four and paid by quarter.

Your contribution rate can change annually based on state unemployment agency evaluations. They will assess your business and score it based on the number of former employees that filed for unemployment benefits the previous year.

Are Employers Responsible For Paying Unemployment Taxes

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Garrison Shops Had A Suta Tax Rate Of 3 7 The State S Taxable Limit Was 8 000 Of Each Employee S Brainly Com

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Futa Suta Unemployment Tax Rates Procare Support

Oed Unemployment Ui Payroll Taxes

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

2022 Federal State Payroll Tax Rates For Employers

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

Futa Tax Overview How It Works How To Calculate

Glencoe Mcgraw Hill Payroll Taxes Deposits And Reports Ppt Download

How To Calculate Unemployment Tax Futa Dummies

What Is Sui State Unemployment Insurance Tax Ask Gusto

Suta Vs Futa What You Need To Know

What S The Cost Of Unemployment Insurance To The Employer

Payroll Taxes Deposits And Reports Section 2 Unemployment Tax And Workers Compensation Chapter 11 Section Objectives 6 Compute And Record Ppt Download